since 2019, according to a recent study.**

*109 claims per million members in 2019 to 158 in 2022.

**SunLife study from May 2023.

Stop-Loss coverage de-risks self-funded employers from catastrophic or unpredictable losses associated with high-cost claimants. Stop-Loss itself is not medical insurance – it’s a financial and risk management tool.

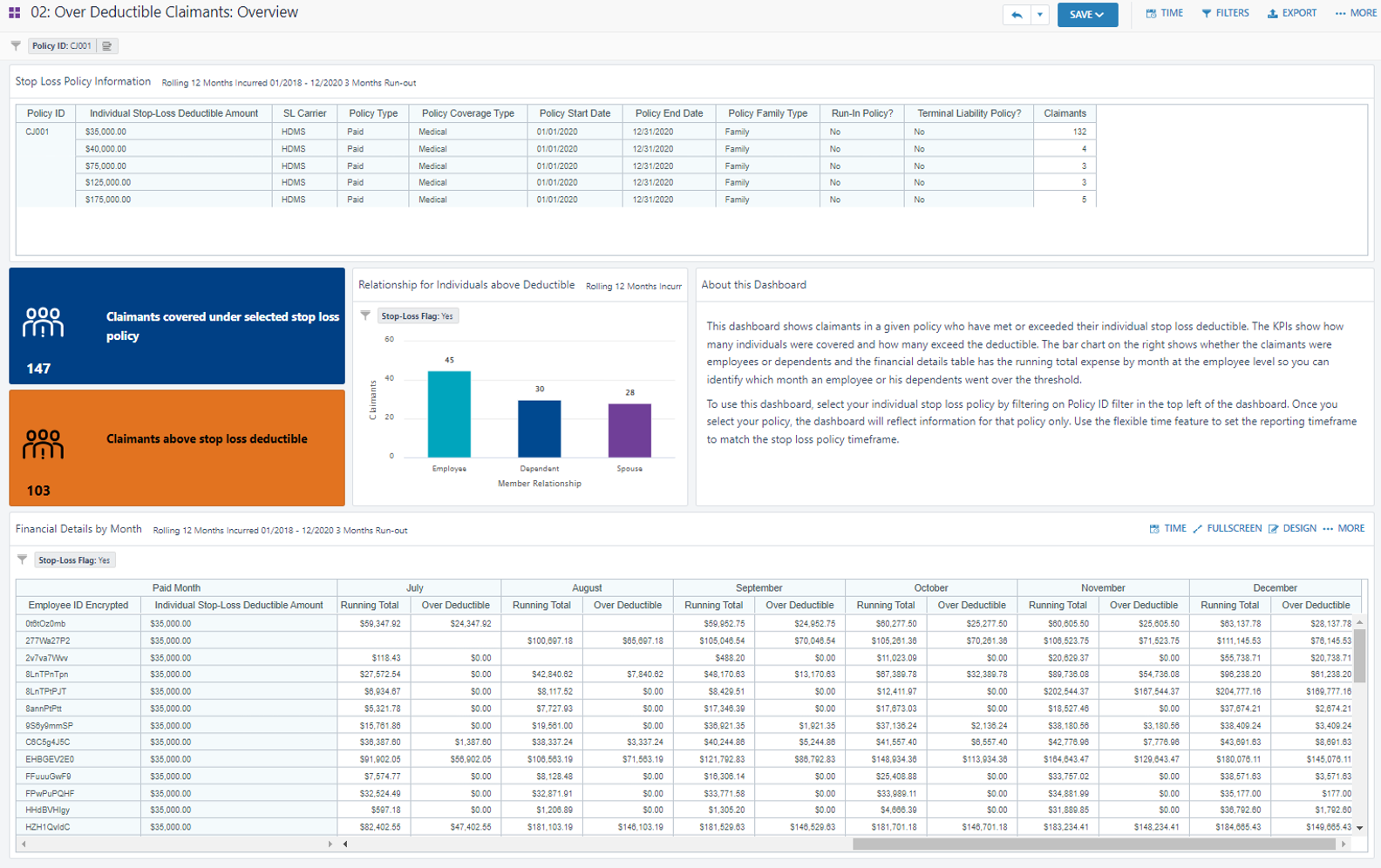

Annual premiums increase when too many claimants exceed their deductible. Be data-driven to reduce long-term costs.

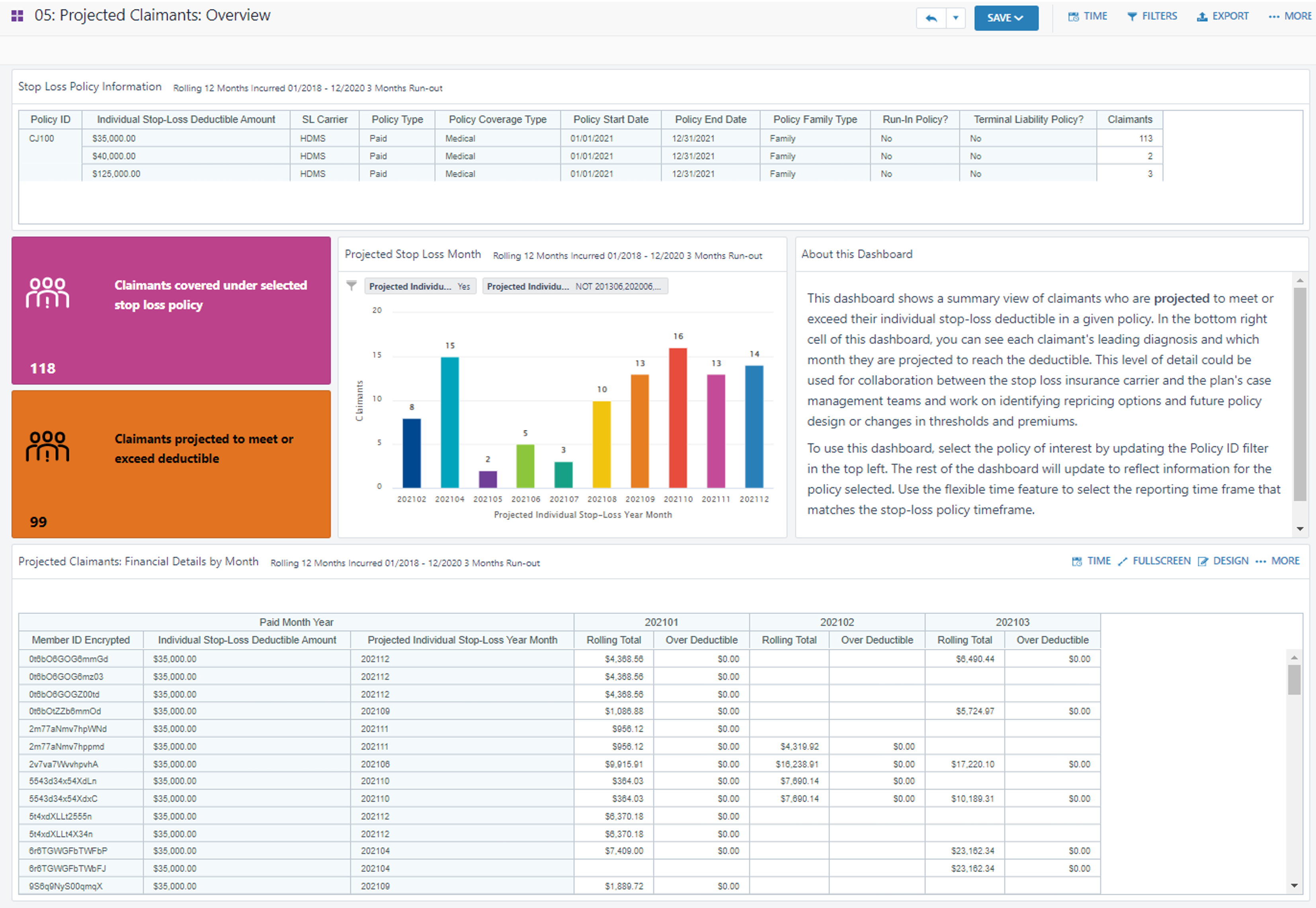

See members and amounts, even before they hit a Stop-Loss deductible threshold. See details around:

Flags members that meet policy trigger criteria (diagnoses, conditions, specialty Rx, etc.) on a running basis. See running totals.

Shows month-by-month actuals and projections. See who is likely to meet or exceed deductibles and when for accurate planning.

Uncovers rising risk. See who is approaching (configurable) thresholds, like 80% deductible AND projected year-end estimates.

Ingests your existing policy and adapts analytic processing to your contract details

Reports reflect your policy, configured thresholds, and risk definitions

Predicts which members will meet deductibles

Process sophistication accounts for Laser lists and varying deductibles.

Increase the accuracy of forecasts, plans, budgets, spend and financial reporting

Design across health plan and stop loss policies to optimize costs

Help members with hyper-personalized care plans and healthcare resources

Stop-Loss policies are highly customized. Many include laser lists – these contain specific individuals expected as high-cost claimants. These individuals have a unique (higher) deductible.

Accurate laser lists ultimately keep Stop-Loss premium lower for the rest of the population.

Smart Stop-Loss packages up information for easy decision-making for next year’s laser lists based on existing health profiles and individual costs.

All analytic views produce results that account for each member’s unique deductible amount.

Learn more